Configure dashboards to fit your teams’ processes and answer the questions on which success hinges – overall win rate, pipeline health, lead sources, top performers and more.

Capital Raising Dashboards

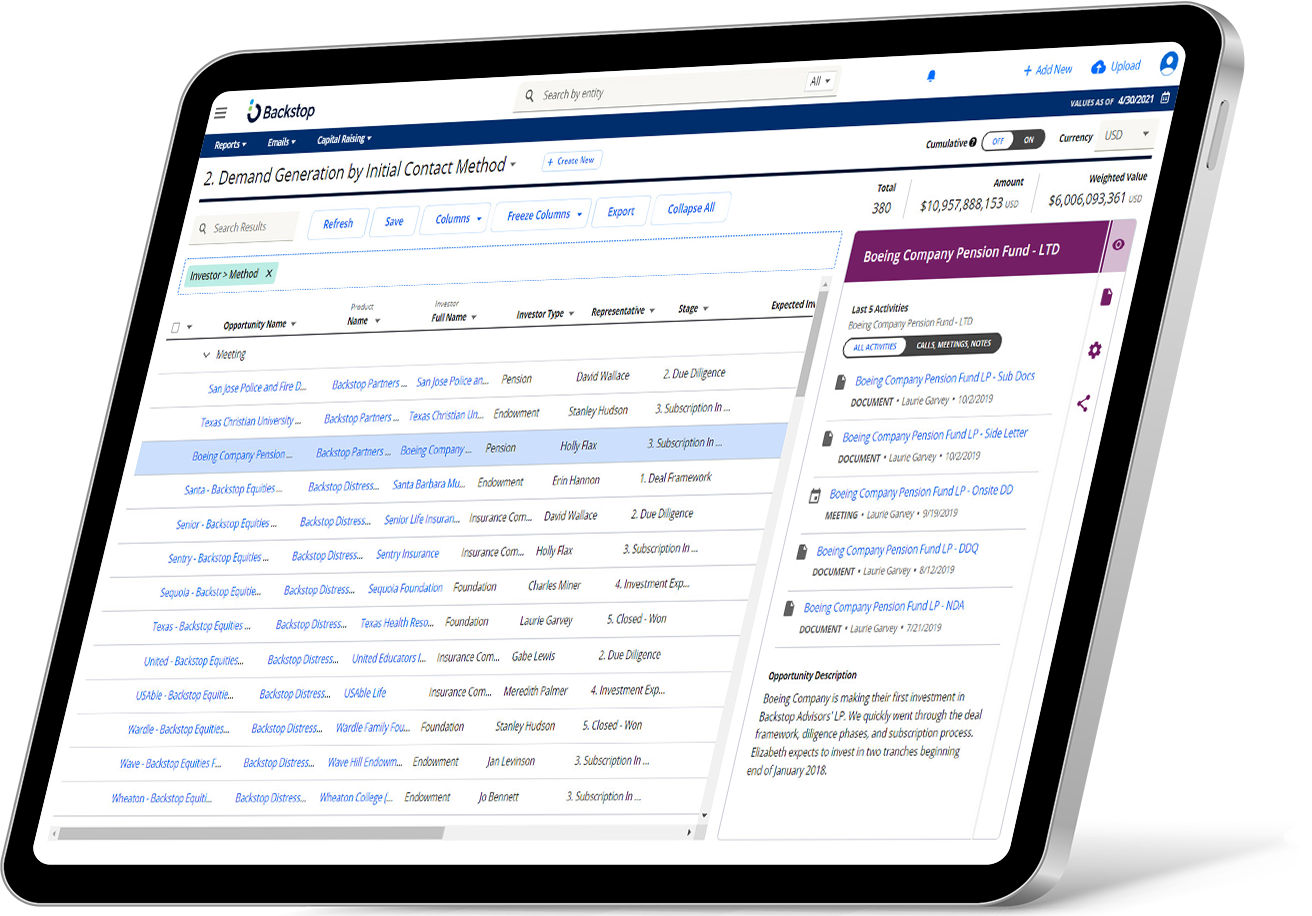

Pipeline Manager

View granular pipeline data in real-time to determine your optimal next steps. Cut and sort according to team members, geography, lead source, opportunity stage and other metrics.

Capital Raising in action

Private Fund Managers (GPs)

Discover a dynamic, adaptable platform that will truly set your firm apart. Backstop empowers you with the ultimate single source of truth, revolutionizing how you raise and retain capital, supercharge business development, and foster meaningful connections with allocators, consultants, and other industry participants in your universe. Unlock your firm’s full potential today.

Learn moreConsultants, Advisors & OCIOs

Backstop is your trusted ally in optimizing the investment and client life cycle. Our solutions create a single source of truth for multi-asset research and portfolio management, driving prospect and client satisfaction, fostering loyalty and ensuring long-term retention. Stay ahead of the competition with Backstop’s cutting-edge solutions.

Learn moreCapital Raising up close

Confident, timely decisions

Confident, timely decisions

Use real-time data to focus the right resources on the right opportunities.

Nurturing relationships

Nurturing relationships

Get deeper insights into individual prospects to optimize account management.

Operational agility

Operational agility

Access crucial information, manage contacts and add notes on the go with Backstop Mobile.

Maximal win rate

Maximal win rate

Focus on the most relevant, promising opportunities according to probability.

Enhanced productivity

Enhanced productivity

Optimally leverage your prospect database to maximize capital raising success.

A flexible solution

A flexible solution

Manage opportunities through successive pipeline stages or update them in bulk.

What Our Clients Say About Us

I work in Backstop 8 hours a day, 5 days a week. It is our document database and main data depository. It provides us with the tools we use on a daily basis to both analyze and house our data and all the documents that we receive. Besides ease of use, ease of reporting, and ease of viewing, the Backstop Support people are top of class.

Kathy McLean

Backstop is the most flexible and intuitive CRM system I’ve used.

Maria Szabo

By using Backstop, our managers can easily access financial information and analysis anytime when making investment decisions.

Camilla Burke

It is an excellent product, allowing us to effectively “mirror” our Trustee record keeping; which provides us the ability to reconcile and identify any potential errors and strengthens our level of assurance.

Rosele Watro

Backstop allows us to maintain the organization’s memory. Turnover is an unavoidable truth in any institution. As people go, they take with them crucial knowledge. Backstop is how we can mitigate this…the system helps to keep track of all the conversations we have and all the people we have them with.

Mark Montoya

Breadth of functionality. Quality of customer service. Strong focus on innovation, product improvement, and customer needs.

Rip Mecherle

Great relational database for information tracking, contact management, client management, distribution, and accounting.

Chris Arends

Backstop is a key client engagement tool within our advisory business. Their customized software configurability and flexibility, along with client service, have made Backstop a key partner for our firm.

David Gold

It fills a huge void we had in tracking managers, contacts and performance. User friendly, responsive support.

Matt Orr

We’re excited to partner with ION Analytics and Backstop Solutions. We believe it will allow us to continue delivering our investment technology strategy for better client outcomes.

Joe Wiggins

Backstop’s user-friendly tools simplify reporting and tracking, seamlessly integrating with our daily workflow. As our investment and fundraising plans evolve, we believe Backstop Solutions is the right choice for Paine Schwartz Partners.

Natalya Michaels

Backstop has transformed how we operate by giving us more time to focus on what matters–delivering value to our clients.