Client meetings are essential for investment consultants and OCIOs, but they often come with unnecessary stress. Preparing portfolio updates, benchmarks, and relevant research and ratings usually involves juggling spreadsheets, pulling data from multiple systems, and working to reconcile those disparate components.

Modern firms are moving away from manual tracking toward integrated portfolio monitoring solutions that automate reporting, benchmark comparisons, and data aggregation — freeing consultants to focus on what really matters: client conversations.

Imagine walking into a client review not only confident in the portfolio’s investments and contributions but also equipped with the “why” — supported by your firm’s research and ratings on those underlying investments. It’s one thing to recite performance metrics, it’s another to explain the drivers behind them. Now, you can deliver insights grounded in institutional knowledge that only your team can provide.

Now, with Backstop’s portfolio monitoring tools, consultants can deliver insights grounded in institutional knowledge that only their team can provide.

See how our monitoring solution keeps consultants ahead of client expectations — Download the RMS data sheet.

The problem: Manual portfolio monitoring creates risk

Many consultants still rely on fragmented processes:

- Manual data entry that increases the risk of errors.

- Slow turnaround when clients request portfolio updates or research insights into their investments or asset classes.

- Limited visibility into whether investments align with benchmarks or policy guidelines backed by firm research.

When client questions come up — especially unexpected ones — consultants often scramble to pull information together. This not only creates stress before meetings but can also erode client confidence.

Manual workflows break down under pressure. Without automated systems, even well-prepared consultants risk delays, inconsistent data, and missed insights, all of which can impact client trust and long-term retention.

The solution: Automated, collaborative portfolio monitoring

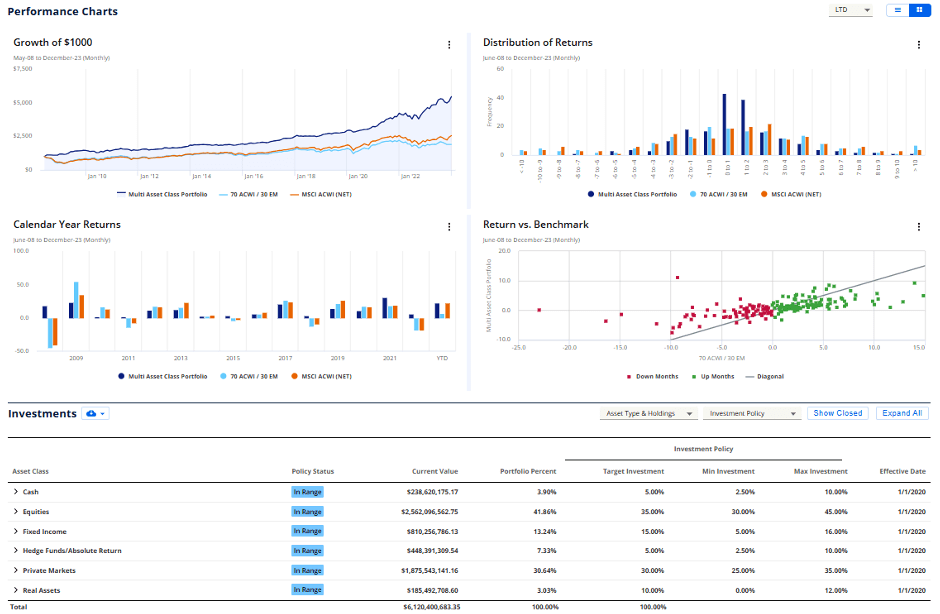

Fig. 1 – Policy tracking view on a portfolio

With an integrated portfolio monitoring solution, investment consultants and OCIOs can:

- Track portfolios across currencies and asset classes in a single, unified platform.

- Compare performance against weighted benchmarks

- Flag policy adherence issues early, so conversations are proactive instead of reactive.

- Streamline research into reporting, ensuring consultants spend less time compiling data and more time advising.

By combining RMS capabilities with advanced portfolio analytics solutions, consultants can move beyond reporting to truly interpret and communicate performance drivers to clients.

Use case one: Smoother client reviews with RMS

A global consulting firm prepared quarterly reviews for more than 50 institutional clients. Instead of pulling data manually, consultants logged into the monitoring platform and accessed dashboards with performance and benchmark comparisons already updated.

Because Backstop’s investment management workflow automates data refreshes and report generation, preparation time dropped by 40%. Consultants reported walking into meetings with greater confidence to address questions and minimize surprises.

Use case two: Handling on-demand requests with confidence

Clients often request research not only on their specific investments but also on the broader asset class. Any OCIO can confidently aggregate research tied to the investments in a client’s portfolio, but the real value comes from going further.

With Backstop’s automated investment software and integrated research management capabilities, consultants can instantly pull additional insights compiled across the entire asset class. This means faster responses, more context, and greater confidence in every client interaction.

This level of automation turns client questions into opportunities to demonstrate expertise, accuracy, and the strategic value of your advisory relationship.

Why portfolio monitoring should build trust, not stress

In a market where clients expect speed, precision, and transparency, consultants cannot afford outdated processes.

Effective portfolio monitoring is not just about tracking performance — it’s about demonstrating control, foresight, and credibility.

Portfolio monitoring shouldn’t be a source of stress — it should be the foundation of client trust.

Give your clients greater confidence — Request a demo